MACD is one of the most commonly used technical trading indicators in forex.

This utterly simple strategy will help you to trade MACD with the short-term trend.

Great for scalping and day trading currency pairs.

Trading Tools/Settings

Indicators: MACD (moving average convergence/divergence) with default settings(12,26,9).

Time frame(s): 5 Min and above

Trading sessions: All

Currency pairs: All

Download

Download the Simple MACD Strategy.

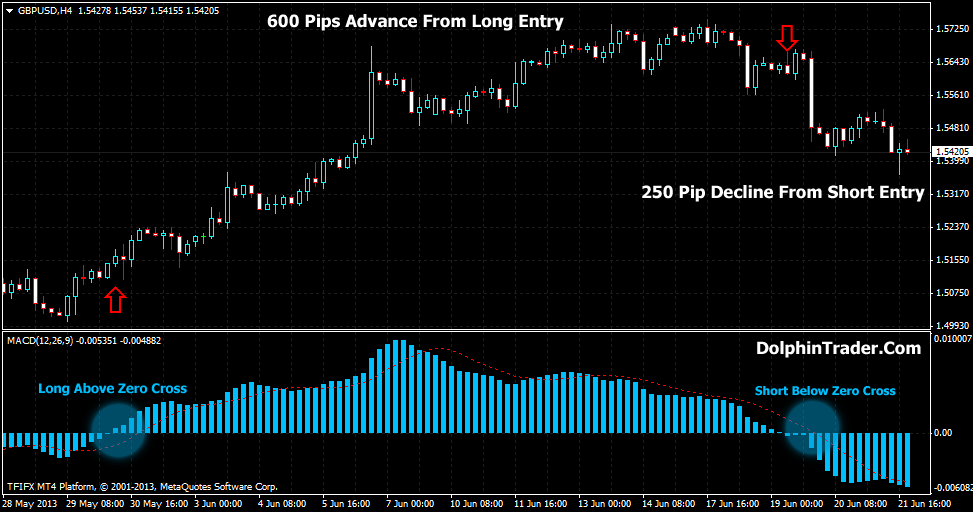

GBP/USD 4 Hour Chart Example

Trading Rules

Long Entries:

- MACD histogram closes above it’s zero line from below.

Place protective stop-loss below the most recent support area. Take profit when the MACD crosses below the zero line from above(basic MACD exit strategy).

Other buy exit strategies: Exit long trade at 1:2 risk-to-reward. Exit at key resistance levels. Exit long trade at trend line violation.

Trend Line Violation (GBP/USD Long trade closed for 464 pips)

Short Entries:

- MACD histogram closes below it’s zero line from above.

Place protective stop-loss above the most recent resistance area. Take profit when the MACD crosses above the zero line from above(basic MACD exit strategy).

Other sell exit strategies: Exit short trade at 1:2 risk-to-reward. Exit at key support levels.

Advantages of basic strategies with MACD

Very easy to apply. Works well in trending markets.

Disadvantages

It doesn’t perform well in range-bound “flat” markets. Use in conjunction with other indicators or techincal analysis tools.