The sMAMA forex scalping strategy deploys a simple set of trading rules and integrates 3 free forex indicators in generating buy/sell signals. Download this strategy below.

Chart Setup

MetaTrader4 Indicators: sMAMA.ex4 (width modified = 2), Stochastic_Cross_Alert.ex4 (default setting), Fisher_org_v12.ex4 (default setting)

Preferred Time Frame(s): 1-Minute, 5-Minutes, 15-Minutes

Recommended Trading Sessions: New York Open & London Open

Currency Pairs: Any low spread pair, for example: EUR/USD, USD/JPY, GBP/USD,..

Download

Download the sMAMA Forex Scalping Strategy

Buy Trade Example

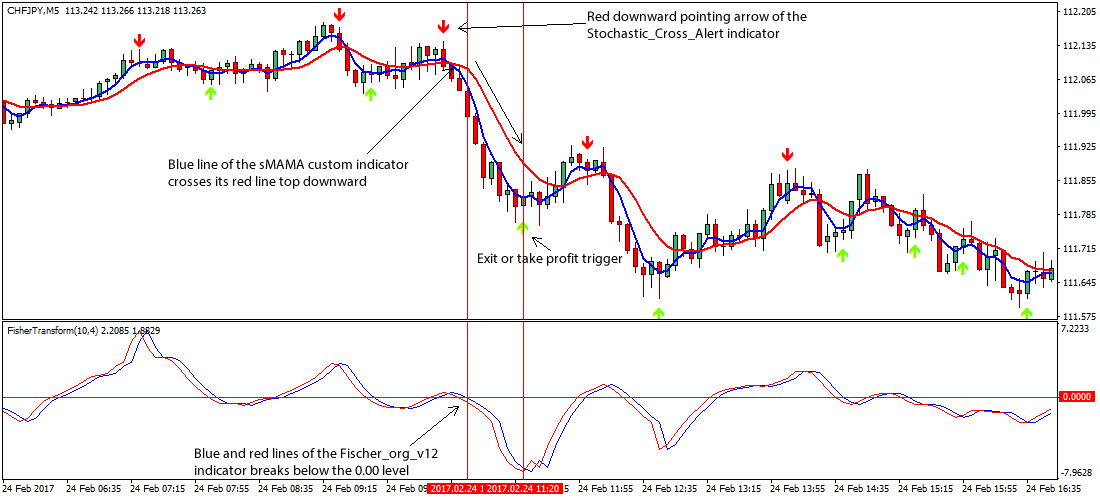

Fig. 1.0

Strategy

Long Entry Rules

Initiate a buy entry if the following chart or indicator patterns are on display:

- If the Lawn green upward pointing arrow of the Stochastic_Cross_Alert.ex4 indicator forms below the candlesticks, price is said to be pressured higher i.e. a bullish signal.

- If the Blue line of the sMAMA.ex4 custom indicator crosses its red line bottom up, it is a trigger to go long on the pair of interest.

- If the blue and red line of the Fisher_org_v12.ex4 indicator breaks above the 0.00 signal level, it is a trigger to go long on currency pair in view.

Stop Loss for Buy Entry: Place stop loss below immediate support.

Exit Strategy/Take Profit for Buy Entry

Exit or take profit if the following rules or conditions take precedence:

- If the red downward pointing arrow of the Stochastic_Cross_Alert.ex4 indicator forms above the candlesticks, it is a signal that buyers are weaning i.e. an exit or take profit trigger.

- If the Blue line of the sMAMA.ex4 custom indicator crosses its red line top downward as shown on Fig. 1.0, it is a trigger to exit or take profit accordingly.

- If the blue and red line of the Fisher_org_v12.ex4 custom indicator breaks below the 0.00 signal level, it is a trigger to exit or take profit as well.

Sell Entry Rules

Initiate a sell if the following rules or conditions are intact:

- If the red downward pointing arrow of the Stochastic_Cross_Alert.ex4 indicator forms above the candlesticks, price is said to be pressured lower i.e. a bearish signal.

- If the Blue line of the sMAMA.ex4 custom indicator crosses its red line top downward, it is a trigger to go short on the pair of interest.

- If the blue and red line of the Fisher_org_v12.ex4 indicator breaks below the 0.00 signal level, it denotes an alert to go short i.e. a sell signal.

Stop Loss for Sell Entry: Place stop loss above immediate resistance.

Exit Strategy/Take Profit for Sell Entry

Exit or take profit if the following rules or conditions take footing:

- If the Lawn green upward pointing arrow of the Stochastic_Cross_Alert.ex4 indicator forms below the candlesticks, it is a sign of declining sellers i.e. a trigger to exit or take profit.

- If the Blue line of the sMAMA.ex4 custom indicator crosses its red line bottom up as shown on Fig. 1.1, it is a trigger to exit or take profit accordingly.

- If the blue and red line of the Fisher_org_v12.ex4 custom indicator breaks above the 0.00 signal level, it is a trigger to exit or take profit as well.

Sell Trade Example

Fig. 1.1

Free Download

Download the sMAMA Forex Scalping Strategy

About The Trading Indicators

The Stochastic_Cross_Alert.ex4 is a custom indicator that is derived from the Stochastic and Moving Average MT4 indicator.

The workings of the Stochastic_Cross_Alert.ex4 is such that a buy/sell signal is issued when the arrows on the chart is painted Lawn green (upwards)/red (downward).

The sMAMA.ex4 custom indicator is a trend following that consists of two lines (blue and red) that are attached to the chart.

The Fisher_org_v12.ex4 custom indicator is an oscillator that consists of two lines, a red and a blue line.

The lines oscillate around the 0.00 signal level. Price is bullish or bearish when the lines are aligned above/below the signal level respectively.