Take advantage of the smoothed Heiken Ashi candlestick with this simple versatile trading strategy.

It can be used for all trading styles including scalping and day trading.

Chart Setup

Indicators: Heiken_Ashi_Smoothed, 144 Period Simple Moving Average

Preferred time frame(s): Any

Trading sessions: Any ( Euro and US Session for scalping)

Preferred Currency pairs: Any

Download

Download the Simple Versatile Forex Strategy With Heiken Ashi Candlestick for Metatrader 4.

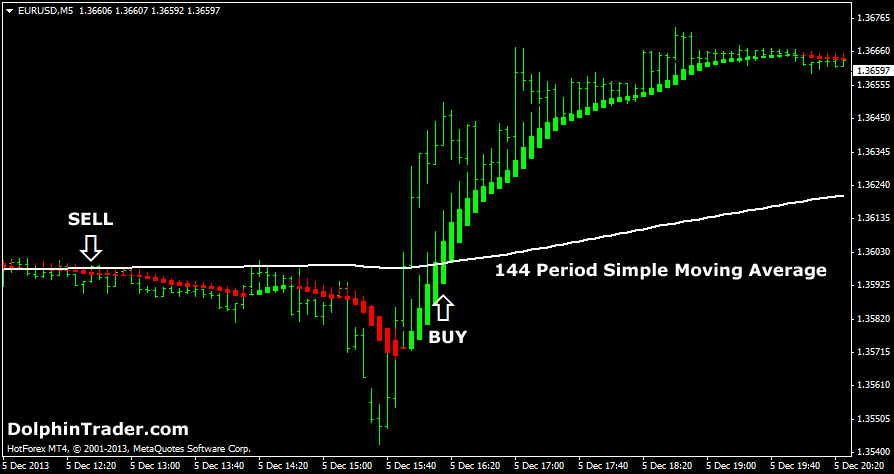

EUR/USD 5 Min Chart

The 5 minute chart shows you a buy and sell trade.

Red Heiken Ashi candlestick below the 144 SMA gives sell signal.

On the contrary, green Heiken Ashi candlestick above the 144 SMA gives buy signal. Click the chart to enlarge.

Trading Rules

Buy Rules:

- Criteria #1: Heiken Ashi candlestick has to close above the 144 period SMA

- Criteria #2: Heiken Ashi candlestick must be green

This is your buy entry.

Stop-loss method:

1) Place stop below the previous swing low.

2) Close the trade when opposite signal (sell) is triggered.

Price Objectives (partial profit taking):

Book 50% profits at 1:1 risk-to-reward. Book 50% profits at 1:3 (use trailing stop).

Sell Rules:

- Criteria #1: Heiken Ashi candlestick has to close below the 144 period SMA

- Criteria #2: Heiken Ashi candlestick must be red

This is your sell entry.

Stop-loss method:

1) Place stop above the previous swing high.

2) Close the trade when opposite signal (sell) is triggered.

Targets: See buy trading rules.