This scalping strategy works with the 1-minute time frame.

It’s quite simple to understand and is composed of the Stochastic indicator and MACD.

Scalping Setup

Indicators: Stochastic with settings: (5,3,3) and MACD with settings: (13,26,9)

Preferred time frame(s): 1 min chart

Trading sessions: Euro ans US Sessions

Preferred Currency pairs: Medium to high volatility pairs (EUR/USD, GBP/USD, USD/JPY, GBP/JPY, EUR/JPY,…)

Download

Download the Forex Scalping Strategy With MACD and Stochastic for Metatrader 4.

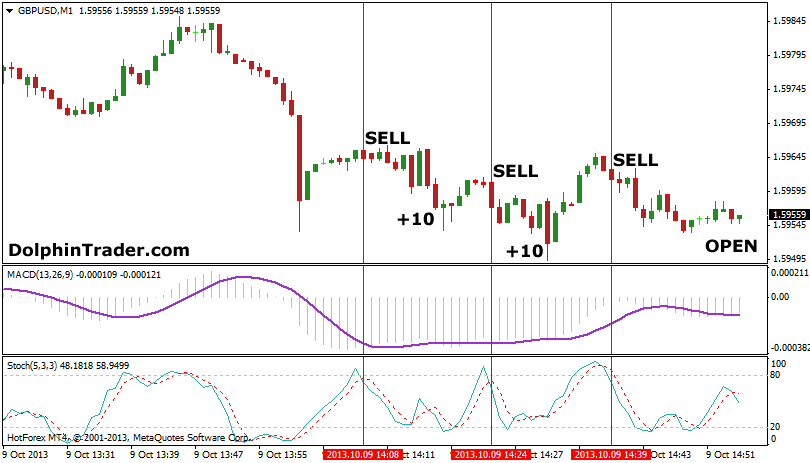

GBP/USD 1 Min Chart Example

Trading Rules

Long Trade Setup:

- The MACD indicator must be above the zero line (bullish territory).

- Wait for the Stochastic indicator to go back above 20 from below (oversold).

This is the signal to enter a long position.

Place stop loss 1 pip below the most recent swing low point.

Price objective: Set at 10 pips above the entry point.

Short Trade Setup:

- The MACD indicator must be below the zero line (bearish territory).

- Wait for the Stochastic indicator to go back below 80 from above (overbought).

This is the signal to enter a short position.

Place stop loss 1 pip above the most recent swing high point.

Price objective: Set at 10 pips below the entry point.

Trading Example

The GBP/USD 1 minute chart provided us with 3 short signals. Two trades were closed for 10 pips profit each (20 pips total). The last trade hasn’t achieved the profit target yet.